Top 20 Pre-Seed Investors in 2025

Explore the top pre-seed investors of 2025, offering vital funding, mentorship, and resources for early-stage startups across various sectors.

Looking for funding to kickstart your startup? Here’s the ultimate guide to the top 20 pre-seed investors in 2025. These firms specialize in early-stage funding, offering more than just capital - they provide mentorship, resources, and networks to help founders succeed.

Key Highlights:

- Precursor Ventures: Focuses on people over products, investing up to $500K in pre-seed rounds.

- NFX: Known for scalable tech and free tools like Signal to assist founders.

- E²JDJ: Prioritizes AgriFood innovations tackling climate and food security challenges.

- Y Combinator: Offers funding plus a 3-month accelerator program with global reach.

- 500 Global: Combines funding with a structured 4-month accelerator program.

- Founder Collective: Backs bold ideas with a founder-first approach, emphasizing capital efficiency.

Quick Overview:

- What they fund: Sectors like AI, FinTech, EdTech, consumer products, and AgriFood.

- Check sizes: Ranging from $10K to $1M.

- How to apply: Warm introductions, online applications, or direct outreach depending on the firm.

These investors are shaping the future by backing visionary founders at the earliest stages. Whether you’re building in AI, healthcare, or consumer tech, this guide connects you to the right partners to launch your venture.

Raising PRE-SEED or SEED in 2025? Use this CHEAT CODE (Most Startups Won't)

1. Precursor Ventures

Precursor Ventures has carved out a reputation as a highly founder-focused pre-seed investor in the U.S. Under the leadership of Managing Partner Charles Hudson, the firm prioritizes the people behind the ideas rather than the products themselves - a philosophy that sets it apart in the early-stage investment landscape.

In April 2025, the firm announced the close of its fifth fund, raising $66 million. With an active portfolio strategy, Precursor Ventures makes 30–40 investments annually, with roughly 24% at the pre-seed stage. Acting as the first institutional backer for many startups, the firm typically invests up to $500,000 in pre-seed rounds and up to $5 million in seed rounds.

The firm's guiding principle is simple yet impactful:

"We invest in people over product at the earliest stage of the entrepreneurial journey."

Precursor Ventures emphasizes the importance of the founding team above all else, adhering to the belief that Team > Market > Product. This approach reflects their conviction that the team forms the unchanging core of a startup's DNA.

Key Investment Focus for 2025

Precursor Ventures targets a range of sectors poised for growth, including:

- FinTech – Solutions for financial services and payments

- Consumer – Direct-to-consumer products and services

- EdTech – Platforms revolutionizing education

- Digital Health – Innovations in healthcare and wellness

Their portfolio spans both software and hardware, keeping a pulse on emerging trends across industries. Notable investments include companies like The Athletic (acquired), Juniper Square, Superhuman, Kit (acquired), and Incredible Health. In 2025, the firm supported standout founders such as Laura Modi of Bobbie baby formula and Doktor Gurson of Rad AI, even when past ventures hadn’t gone as planned.

"We aggressively back entrepreneurs who have something to prove."

While Precursor Ventures primarily focuses on startups in North America - including the U.S., Canada, and Mexico - it remains open to opportunities beyond these regions. The firm also places a strong emphasis on diversity, actively seeking out founders with a wide range of backgrounds, including differences in gender, race, education, and life experiences. This commitment to inclusivity underscores its role as a forward-thinking leader in the pre-seed investment space.

2. NFX

After Precursor Ventures, NFX steps in as a key player, focusing on pre-seed and seed-stage startups. Their primary interest lies in scalable tech and consumer-focused companies, with investments aimed at driving significant growth potential.

What sets NFX apart is their use of digital tools, like Signal, to provide free software resources that help early-stage entrepreneurs navigate their challenges. This approach highlights a growing trend where investors go beyond funding to offer practical, hands-on support to founders.

3. E²JDJ

E²JDJ is a pre-seed investment firm with a sharp focus on AgriFood. Their mission is to back early-stage ventures that aim to improve the quality and resilience of the food system. They look for scalable solutions to tackle pressing issues like climate change, public health challenges, and food security. Their investment scope spans the entire food value chain, or as they put it, "from seed to site".

The firm has a keen eye on cutting-edge food technologies, including cell-based, plant-based, and fermentation-based alternatives. They prioritize next-generation food products that are clean label and nutritious, steering clear of heavily processed options with ingredients like saturated fats, modified fats, fillers, and stabilizers.

E²JDJ's portfolio leans heavily on deep-tech innovation. They integrate advanced tools like synthetic biology, AI, machine learning, quantum computing, and genetic sequencing to make groundbreaking technologies more accessible and cost-effective. By doing so, they aim to drive transformative changes in the $4 trillion bioeconomy.

Some of their recent investments highlight their forward-thinking approach. For example, Perfeggt is working on plant-based egg alternatives, Aigen uses AI-driven solar-powered robots for scalable crop weeding, and Plantish is pioneering alternative fish production. These investments reflect their commitment to scalable, tech-driven solutions that address major global challenges like climate change and food security.

"We invest in innovators that are truly shaking up every component of the food value chain from seed to site."

– Stephanie Dorsey, Founding Partner, E²

In line with their focus on pre-seed opportunities, E²JDJ provides accessible funding for entrepreneurs developing sustainable food technologies.

4. Yes VC

Yes VC is identified as a pre-seed investor as of 2025. However, there’s currently limited information available about its specific investment focus, decision-making process, or how it supports startups. Updates will be provided as additional details emerge.

5. Launchpad Capital

Launchpad Capital stands out in the pre-seed investment space with its unique, multi-vehicle strategy. Unlike traditional venture capital firms, they invest through various channels, including venture capital, SPACs, credit, and even sports, enabling them to tap into a wide range of early-stage opportunities.

What sets them apart is their commitment to being more than just financial backers. They collaborate closely with teams from the very beginning, providing not only funding but also ongoing support to help turn ambitious ideas into thriving businesses. This hands-on approach ensures that startups receive the guidance they need during the most critical early stages of growth.

This strategy highlights a shift in the pre-seed investment landscape, where firms are exploring new ways to support startups beyond the traditional venture capital model. By diversifying their approach, Launchpad Capital is helping to redefine how early-stage ventures are nurtured.

6. Cake Ventures

Cake Ventures is another standout among the top pre-seed investors for 2025, following Launchpad Capital. While details about its specific investment approach aren't widely available, it's best to check the firm's official resources for the most up-to-date insights.

7. First Round Capital

First Round Capital works closely with early-stage founders, concentrating on seed-stage investments. While they primarily focus on seed funding, they show a strong interest in founders who bring bold, unconventional visions to the table. For pre-seed founders aiming to catch their attention, it's crucial to clearly communicate what makes your idea stand out and why the timing is right. Their emphasis on visionary thinking makes them a key player for founders looking to make a mark early on.

8. Pear.vc

Pear.vc is a pre-seed and seed investment firm that takes a hands-on approach to supporting early-stage founders. They go beyond simply providing funding by offering a well-rounded support system. One key initiative is their accelerator program, PearX, which actively scouts for new talent. For instance, the Spring 2025 cohort accepted applications until September 13, 2025, highlighting their dedication to discovering and nurturing promising startups.

The firm has also shown a strong interest in AI startups, aligning with the rapid growth of the sector. Pear.vc provides startups with full-service support that includes in-house recruiting to help build teams, guidance on go-to-market strategies, and assistance with securing additional funding in later stages.

For founders based on the West Coast, Pear.vc offers physical workspaces through its Pear Studio locations in San Francisco and Menlo Park. These spaces encourage collaboration and resource-sharing among portfolio companies. With its accessible accelerator program and dedicated workspaces, Pear.vc creates an environment where founders can thrive and grow their ventures.

9. Launch Capital

Launch Capital operates in a challenging pre-seed market, shaped by a drop in early-stage funding. In the first quarter of 2025, early-stage and seed funding saw a noticeable decline, making it more difficult for startups to secure their first investment rounds. This has created a more competitive environment where investors are prioritizing startups with standout value propositions and strong patent strategies.

This backdrop heavily influences Launch Capital's current investment strategy. In Q1 2025, 71% of venture funding went to AI and machine learning startups, highlighting the growing interest in tech-driven businesses.

Interestingly, while the median early-stage VC deal size climbed to $7 million in Q1 2025 - a 27% increase - the overall number of deals dropped. This trend indicates a shift toward fewer but larger investments.

For pre-seed funds like Launch Capital, the focus often leans toward disruptive technologies and mission-driven ventures, with these funds being 1.5 times more likely to back such projects compared to seed funds. Launch Capital also stands out for its speed; pre-seed rounds here typically close in about 8 months, which is roughly a month faster than seed rounds. The average check size for these rounds is $1.8 million.

However, the path to liquidity has grown longer. The median time to IPO now sits at 6.1 years, the longest since 2016. This extended timeline means founders need to craft clear growth strategies that account for a prolonged journey to exit.

To attract Launch Capital’s attention, founders should focus on high-demand sectors like AI, robotics, cybersecurity, and defense technology. These areas align with current market trends and provide insight into how founders can position themselves to approach pre-seed investors effectively.

10. Y Combinator

Y Combinator stands out as a top pre-seed investor, offering an accelerator program that blends early-stage funding with a hands-on, three-month experience aimed at shaping startups into investor-ready businesses.

What makes YC different from traditional venture capital firms is its unique approach. It pairs funding with a mentorship-driven program, eliminating the usual complexities of early-stage fundraising. Founders can skip the lengthy deal negotiations and focus entirely on building their products and scaling their teams. This setup removes distractions and puts growth front and center.

YC hosts two cohorts annually, drawing applications from startups worldwide. For instance, the Winter 2025 cohort showcased a wide range of companies, reflecting YC’s dedication to supporting founders with bold ideas.

One of YC’s biggest strengths is its alumni network and the credibility that comes with its name. Graduating from YC opens doors to a massive community of founders who often become customers, collaborators, or even future investors. This network effect becomes a powerful advantage, often matching or exceeding the value of the initial funding.

The application process reflects YC’s focus on founder-driven innovation. Instead of demanding lengthy business plans or intricate financial forecasts, the online application emphasizes the team’s strengths, the product’s potential, and any early momentum. YC partners review applications with a sharp focus on team quality, market opportunity, and early signs of product-market fit.

The program wraps up with Demo Day, where startups get the chance to pitch their vision to a room full of eager investors.

11. 500 Global

500 Global approaches pre-seed investing with a unique twist: they pair funding with a hands-on accelerator program designed to prepare startups for the next big leap. Since launching their accelerator model in 2010, they’ve created one of the largest global networks in venture capital, helping founders from a wide range of markets and industries. This blend of funding and mentorship has become a hallmark of how 500 Global nurtures early-stage ventures.

Their four-month Flagship Accelerator program in Palo Alto offers startups $150,000 in funding. After deducting a $37,500 program fee, participants receive $112,500 in exchange for about 6% equity.

What sets 500 Global apart is its global mindset. They focus on uncovering talent in markets often overlooked by traditional venture capital. Their philosophy? "Talent lives everywhere. Capital and opportunity does not.". This belief drives their mission to support entrepreneurs from regions with limited access to funding, making their approach especially relevant in today’s competitive pre-seed environment.

The accelerator curriculum dives into essential areas like customer discovery, product-market fit, go-to-market strategies, pitch development, and fundraising. Participants also gain access to a vast network of over 5,000 alumni and 400 mentors.

Applications are open year-round at flagship.aplica.500.co. After an initial review, selected candidates go through calls or in-person interviews to evaluate their product’s viability and market potential. Startups accepted into the program must relocate to Palo Alto. 500 Global looks for early-stage tech companies with bold teams, a clear vision for scaling internationally, and evidence of quick execution.

Once the program ends, 500 Global retains follow-on rights to invest up to $500,000 or 20% of the next priced round, whichever is lower. Founders also gain access to the 500 FounderHub, which offers credits and discounts for crucial business tools.

"At 500 Global, we've been empowering visionary founders with a global mindset since 2010." - 500 Global

For those who don’t make the cut initially, there’s still hope. Founders are encouraged to reapply after improving their products - many alumni found success after refining their ideas and trying again.

12. Techstars

Techstars has carved out a unique space in the pre-seed investment world by combining funding with an intensive, hands-on mentorship program. Instead of simply writing checks, Techstars offers a focused three-month mentorship designed to fine-tune business models and get startups ready for future funding rounds.

The program provides startups with direct funding and convertible notes in exchange for equity. But the real magic lies in its extensive network of experienced entrepreneurs and industry experts. With a global presence, Techstars tailors its programs to align with regional strengths and specific industries, helping founders move from early-stage ideas to product testing and, eventually, to high-stakes Demo Day presentations.

Techstars is highly selective, admitting only a small group of startups per program cycle. They focus on the quality of the founding team rather than demanding a fully polished product. Their alumni network includes startups that have reached impressive milestones, further solidifying Techstars' reputation as a launchpad for success.

Even after the three-month program ends, Techstars continues to provide value. Founders gain access to ongoing mentorship, follow-on funding opportunities, and a wide range of corporate partnerships. This all-encompassing approach makes Techstars a standout choice for pre-seed entrepreneurs looking to build a strong foundation for growth.

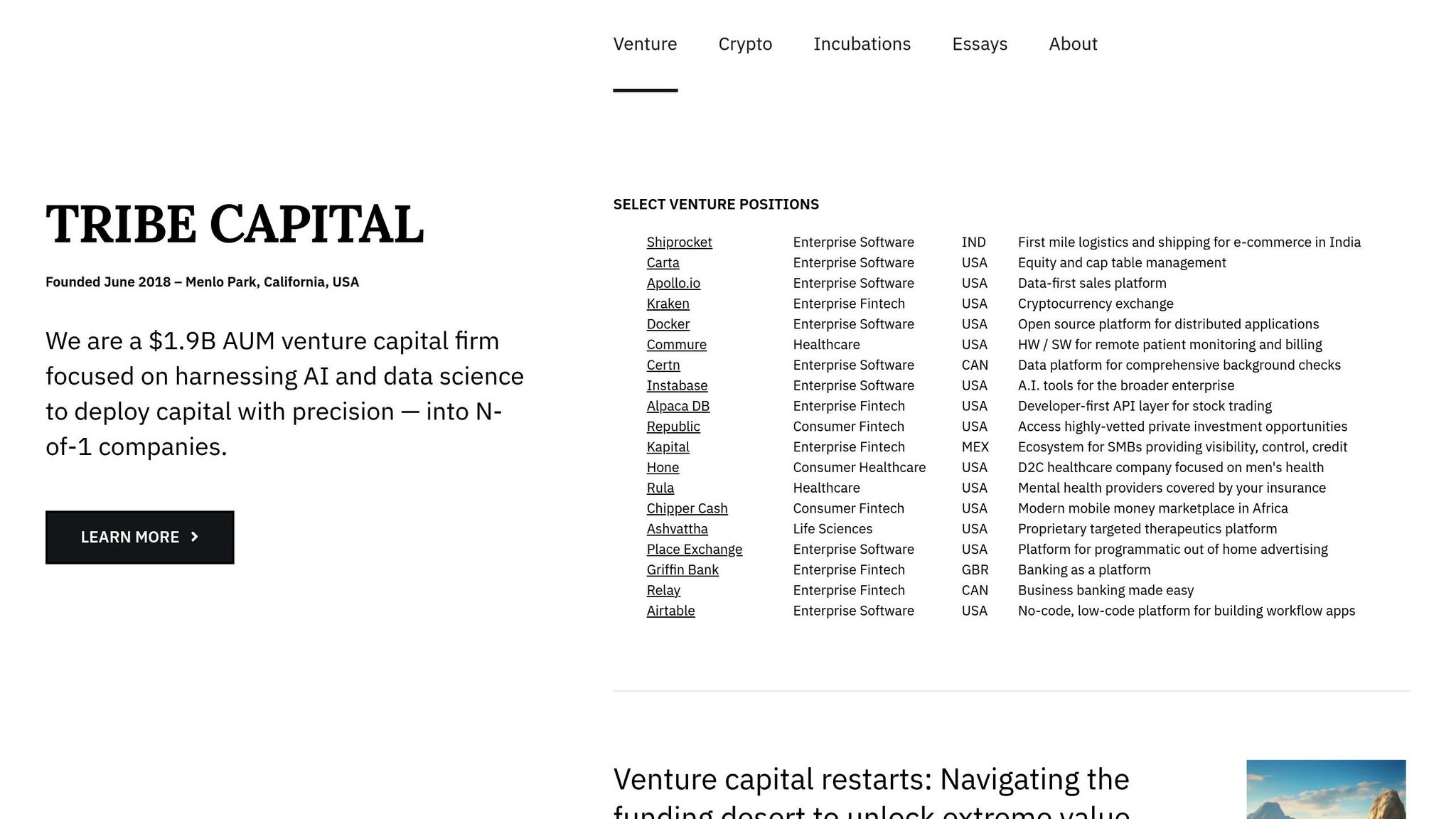

13. Tribe Capital

Tribe Capital stands out as a prominent pre-seed investor, known for its data-driven approach to evaluating startups. By focusing on companies with promising long-term potential, Tribe Capital takes a selective approach to its investments. Beyond funding, it offers strategic advice and continuous support to help its portfolio companies navigate the hurdles of early growth. This commitment has solidified Tribe Capital's reputation as a key player in shaping the success of early-stage startups.

14. Founder Collective

Founder Collective approaches pre-seed investing in a way that breaks from the norm. Instead of chasing trends or sticking to specific sectors, they focus on bold ideas and the founders behind them - no matter the industry. This sector-agnostic, anti-thematic strategy sets them apart in the venture capital world.

Their philosophy revolves around identifying startups that tackle clear customer problems, guided by what they call "impeccable founder/market fit." This mindset has led them to invest in companies that, at the time, seemed unconventional but later transformed entire industries. For example, they invested in Uber when it was just a black car dispatch service and backed WHOOP during a period when wearables were considered a dead market. This founder-first approach is paired with an emphasis on efficient use of capital.

Founder Collective champions capital efficiency as a cornerstone of its strategy. They encourage startups to operate with minimal funding and maintain responsible burn rates, believing that constraints often drive creativity and innovation. A standout example is The Trade Desk, one of their portfolio companies, which only used $7 million in venture funding before reaching a multi-billion-dollar valuation.

To stay aligned with the needs of founders, Founder Collective intentionally keeps its fund sizes below $100 million. Despite this smaller scale, their results speak volumes - they’ve supported over 20 startups that have gone on to achieve billion-dollar valuations. Their approach is all about substance over hype, favoring steady, meaningful growth over fleeting trends.

Their portfolio reflects this focus on transformative ideas. Take Shield AI, for instance: what began as a mission to protect service members evolved into a $5+ billion company that’s reshaping defense technology and artificial intelligence. Or Suno, a company they backed early on, which later revolutionized the music industry with AI-powered innovations.

Micah Rosenbloom, the firm’s Managing Partner, was ranked #20 on Business Insider’s "The Seed 100 List" in 2025, a testament to Founder Collective’s ongoing impact in the pre-seed space. His portfolio spans everything from security systems to pet DNA tests, highlighting the firm’s commitment to supporting ideas that might seem unconventional at first but have the potential to redefine industries.

For entrepreneurs seeking pre-seed funding, Founder Collective offers fast decision-making and avoids drawn-out diligence processes. This makes them an attractive option for founders who value speed and conviction in their funding partners.

15. MS&AD Ventures

MS&AD Ventures, supported by MS&AD Insurance Group Holdings, focuses on providing early-stage startups with funding and access to corporate resources, helping them grow and scale effectively.

16. Schematic Ventures

Schematic Ventures stands out in 2025's lineup of top pre-seed investors with its sharp focus on industrial technology and supply chain innovation.

The firm zeroes in on startups that aim to digitize physical operations or develop groundbreaking systems. Its investment strategy revolves around three key areas: supply chain technology, manufacturing, and software infrastructure. Typically, Schematic Ventures invests up to $2.0 million in early rounds, making them an approachable option for founders at the start of their entrepreneurial journey.

This year, the fund is placing a strong emphasis on Industrial AI, particularly solutions that leverage real-time industrial data and integrate AI agents into factories and infrastructure. This focus aligns with a growing trend of engineers from established industrial startups branching out to create entirely new systems from scratch, guided by first principles.

The firm also sees the continued expansion of e-commerce as a major driver, especially in areas like fulfillment technology.

What sets Schematic Ventures apart is its active engagement with the founder community. Partners maintain visible profiles on LinkedIn, sharing insights and fostering connections with entrepreneurs. Their hands-on approach extends beyond financial backing - they’ve built a reputation for supporting founders and strengthening the industrial technology ecosystem.

If you're working on solutions in manufacturing automation, supply chain optimization, or industrial software infrastructure, Schematic Ventures could be the specialized partner you need. They understand the unique challenges of building technology for the physical world and are well-equipped to help tackle them.

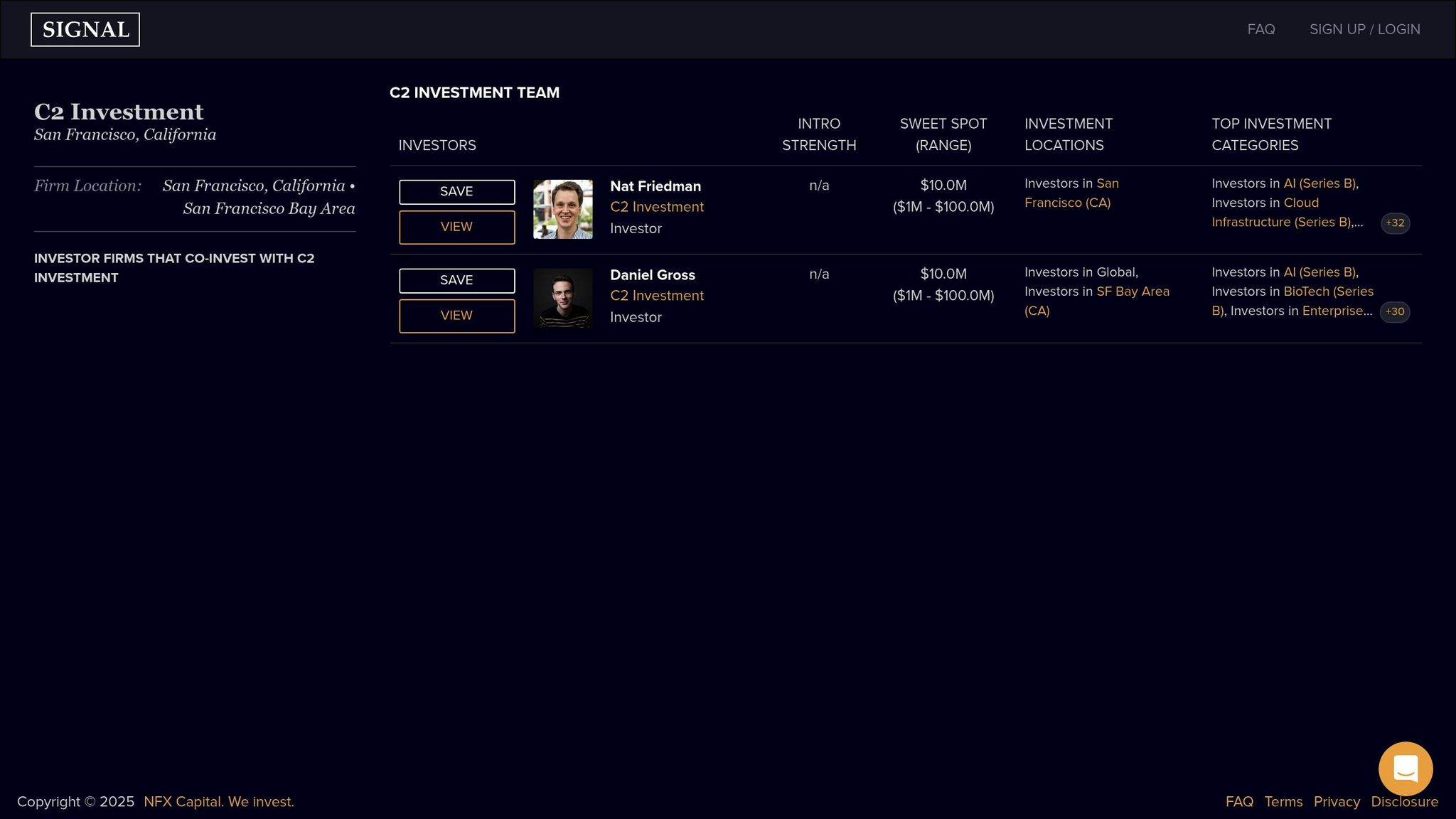

17. C2 Investment (Daniel Gross)

C2 Investment, founded and led by Daniel Gross, is a pre-seed fund dedicated to helping early-stage startups get off the ground. Gross, drawing from his extensive experience as an entrepreneur, provides not just funding but also actionable advice to guide founders through the complexities of launching a business.

The fund zeroes in on tech-driven opportunities, with a particular focus on areas like artificial intelligence, developer tools, and consumer technology. What sets C2 Investment apart is its flexible approach, working closely with founders to tailor support to their specific needs during those critical early days.

For founders looking for more than just financial backing, C2 Investment offers a combination of capital and hands-on mentorship, making it a standout choice in the competitive pre-seed funding space.

18. Safe Superintelligence Inc.

Safe Superintelligence Inc. (SSI) is an AI research lab with a clear and singular mission: to create superintelligent AI systems that prioritize humanity's safety above all else. Every resource at SSI is dedicated to ensuring that their advancements in AI remain aligned with this goal, making them a standout player in the competitive pre-seed landscape.

19. Forum Ventures

Forum Ventures stands out as a pre-seed investor with a strong emphasis on building a community-driven environment. By linking founders with seasoned investors and industry experts, the firm creates a supportive network that spans across various industries.

What sets Forum Ventures apart is its focus on more than just funding. They prioritize strategic advice and open doors to essential networks, encouraging collaboration and shared learning among their portfolio companies. Their founder-first mindset ensures entrepreneurs are part of a network that thrives on mutual growth, fostering partnerships that go beyond financial backing to support long-term success.

This unique approach makes Forum Ventures an essential ally for early-stage founders, especially in today’s landscape where community-driven investment is gaining momentum.

20. FullCircle

FullCircle rounds out our list as a pre-seed fund with a distinct focus on workforce empowerment. They specialize in backing companies that help individuals take charge of their work lives.

This workforce-first mindset is evident in their targeted investments across sectors like SaaS, HR technology, healthcare, and enterprise applications. The fund operates on the belief that the future of work hinges on tools and platforms designed to empower employees. Their investment strategy reflects this commitment.

A standout metric? 69% of their investments happen at the pre-seed stage or earlier. This shows their willingness to take bold risks on fresh, innovative ideas that align with their mission to enhance the workforce experience.

Their portfolio speaks volumes about this focus. For instance, in October 2024, FullCircle invested in SocialCrowd, a seed-stage platform specializing in cloud-based performance management. Earlier, in September 2021, they backed Wethos, a New York-based Series B platform for freelancers. SocialCrowd helps businesses boost employee performance by tracking, reminding, and rewarding achievements - a perfect example of FullCircle’s commitment to worker empowerment. Meanwhile, Wethos supports the gig economy by helping freelancers price projects, upsell services, and delegate tasks to teammates.

What sets FullCircle apart for early-stage founders is their blend of sector diversity and a clear investment thesis. They’ve funded businesses in Enterprise (B2B), SaaS, Software, and Tech, always with a focus on improving the workforce experience.

If you’re building a company in HR tech, employee engagement, or workforce management, FullCircle could be the partner you need to bring your vision to life.

Comparison Table

Match your startup with the right investor by reviewing the key details below.

| Investor | Location | Primary Focus | Notable Investment | Application Process |

|---|---|---|---|---|

| Precursor Ventures | San Francisco, CA | B2B SaaS, AI/ML | Notion, Airtable | Warm introductions preferred |

| NFX | Palo Alto, CA | Network effects, marketplaces | Lyft, Trulia | Online application + pitch deck |

| E²JDJ | New York, NY | Enterprise software, fintech | Plaid, Stripe | Direct outreach to partners |

| Yes VC | San Francisco, CA | Consumer tech, mobile apps | Instagram, Snapchat | Cold emails accepted |

| Launchpad Capital | Boston, MA | Healthcare, biotech | 23andMe, Flatiron Health | Referrals through network |

| Cake Ventures | London, UK | European startups, SaaS | Revolut, Monzo | European founders only |

| First Round Capital | San Francisco, CA | B2B software, consumer | Uber, Square | Warm introductions required |

| Pear.vc | Palo Alto, CA | AI, developer tools | DoorDash, Guardant Health | Partner referrals preferred |

| Launch Capital | New York, NY | Fintech, enterprise software | Robinhood, Coinbase | Direct partner contact |

| Y Combinator | Mountain View, CA | All sectors | Airbnb, Dropbox | Bi-annual application process |

| 500 Global | San Francisco, CA | Global markets, diverse sectors | Canva, Credit Karma | Online application open |

| Techstars | Boulder, CO | Accelerator program | SendGrid, DigitalOcean | Accelerator application |

| Tribe Capital | San Francisco, CA | Data-driven investments | Carta, Kraken | Quantitative pitch required |

| Founder Collective | Cambridge, MA | Technical founders | Uber, BuzzFeed | Founder-to-founder referrals |

| MS&AD Ventures | Tokyo, Japan | Insurance tech, mobility | Lemonade, Root Insurance | Corporate partnership focus |

| Schematic Ventures | New York, NY | B2B infrastructure | Segment, Twilio | Technical deep dives |

| C2 Investment | San Francisco, CA | AI, machine learning | OpenAI, Anthropic | Direct contact with Daniel Gross |

| Safe Superintelligence | Palo Alto, CA | AI safety, AGI research | Anthropic, DeepMind | Research-focused applications |

| Forum Ventures | Toronto, Canada | B2B SaaS, marketplaces | Shopify, Slack | Canadian market preference |

| FullCircle | San Francisco, CA | Workforce empowerment | SocialCrowd, Wethos | HR tech focus required |

The table above provides a snapshot of each investor's focus, location, and application process to help guide your selection.

Beyond these details, it's worth noting that application processes can vary widely. Some funds, like Y Combinator and 500 Global, allow direct online applications, making them accessible to a broader range of startups. Others, such as Precursor Ventures and First Round Capital, prefer warm introductions through their network of entrepreneurs and advisors.

Geography plays an important role in narrowing your options. While many U.S.-based funds invest globally, some have regional preferences. For instance, Cake Ventures focuses solely on European startups, while Forum Ventures leans toward Canadian companies. On the other hand, MS&AD Ventures is heavily focused on insurance and mobility sectors in Japan, leveraging its corporate backing.

Sector alignment is equally crucial. Specialized funds like Launchpad Capital (healthcare/biotech) or Safe Superintelligence (AI research) offer deeper industry expertise and connections. Meanwhile, generalist funds like 500 Global and Techstars provide access to broader networks, though they may lack the niche insights of specialized investors.

Timing is another key factor. Some funds, such as Y Combinator, operate on fixed schedules with specific application deadlines twice a year. Others accept applications on a rolling basis but may have internal preferences tied to their funding cycles or partner availability. Knowing these nuances can help you plan your outreach more effectively.

How to Approach Pre-Seed Investors

Approaching pre-seed investors effectively requires careful planning and strategy. The way you prepare can make all the difference in securing that all-important first meeting. Here’s how to refine your approach and boost your chances.

Start by creating a 10–12 slide pitch deck and a 1–2 page executive summary. These materials should clearly explain your problem, solution, market opportunity, traction, team, and funding requirements. When it comes to financial projections, stick to realistic numbers grounded in actual market data - overly optimistic figures can raise red flags. The executive summary often acts as your first impression, especially when shared through warm introductions, so make it count.

Timing matters. Many venture capital firms review new deals more actively during the first month of each quarter, so plan your outreach accordingly. Avoid reaching out during major holiday periods or the summer months of July and August, when decision-makers are often unavailable. Use tools like Crunchbase or PitchBook to research a firm's recent investments and ensure your pitch aligns with their current focus.

Tap into your network to secure introductions. Whether it’s advisors, customers, fellow entrepreneurs, or founders at firms you’re targeting, these connections can help open doors. When requesting an introduction, offer a brief, customizable email template that includes your elevator pitch and highlights why you’re a great match for the investor. Personalization is key - reference specific portfolio companies that align with your business or mention insights from the investor’s blog posts or interviews. Avoid generic mass emails, as they’re likely to be ignored. Thoughtful, well-researched outreach demonstrates the attention to detail investors value.

If you’re pitching to specialized funds, such as those focused on AI like C2 Investment, tailor your presentation to their expertise. Be ready to discuss your technical architecture, data strategy, and scalability metrics in depth. This targeted approach shows that you understand their priorities and can speak their language.

Strong business planning and presentation skills are essential. A solid grasp of financial modeling, market analysis, and competitive positioning will help you confidently address tough questions. Additionally, storytelling is a powerful tool - crafting a compelling narrative can keep investors engaged throughout your pitch.

Don’t overlook the importance of follow-ups. After your initial outreach, wait about two weeks before following up with any meaningful updates. If you don’t hear back, give it another two to three weeks before reaching out again. This balanced persistence keeps you on their radar without coming across as overly aggressive.

Prepare for due diligence long before you start pitching. Organize your legal documents, financial records, customer references, and technical details in a well-structured virtual data room. Having these materials ready not only demonstrates professionalism but can also speed up the process once an investor shows interest.

Finally, remember that investor meetings are a two-way street. While they’re evaluating you and your business, you should also assess them. Look into their portfolio support, level of involvement, follow-on investment capacity, and decision-making timeline. The best investor relationships are built on mutual respect and shared expectations from the start.

If you’re looking to sharpen your pitch or improve your business planning skills, consider exploring courses from Upskillist - they offer resources tailored to help you succeed in this process.

Conclusion

Selecting the right pre-seed investor can play a pivotal role in shaping your startup's future. The 20 investors featured in this guide represent some of the most active and founder-focused options for 2025, each bringing unique strengths to the table. Whether you're building an AI-driven platform, innovating in consumer tech, or crafting B2B solutions, there's likely an investor here whose expertise and network align perfectly with your goals.

Pre-seed funding isn't just about securing capital - it's about forming partnerships that can propel your growth. Investors like Y Combinator and Techstars offer robust accelerator programs, while funds like C2 Investment specialize in technical support for AI startups. Meanwhile, generalist firms such as First Round Capital and Founder Collective bring a wealth of experience across diverse industries, offering a broad perspective on scaling businesses.

As mentioned earlier, having a clear and compelling pitch deck is essential. Your ability to articulate your vision, showcase early traction, and outline a realistic market strategy can make all the difference in landing that first check. Beyond funding, developing core entrepreneurial skills will strengthen your ability to foster meaningful investor relationships and navigate the challenges of scaling a business.

The funding landscape continues to shift, with investors increasingly prioritizing sustainable growth and clear paths to profitability. They’re looking for founders who can execute efficiently and adapt to market dynamics. This trend aligns with the approaches of the pre-seed investors highlighted in this guide.

For those looking to sharpen their skills, platforms like Upskillist provide targeted courses on business planning, financial modeling, and pitch delivery - key areas that can help you confidently navigate the pre-seed funding journey.

Rejections are part of the process, even for the most successful startups. Each "no" is an opportunity to refine your pitch and better understand what resonates with investors. The right pre-seed investor is out there; it’s all about finding the one who shares your vision and believes in your potential.

FAQs

What should I look for when selecting a pre-seed investor for my startup in 2025?

When choosing a pre-seed investor in 2025, prioritize their industry knowledge and how well their values align with your startup's mission. The right investor can bring more to the table than just capital - look for someone who offers mentorship, strategic advice, and connections to influential networks that can help accelerate your growth.

Take time to assess their track record and reputation in the startup community. It's equally important to carefully review the terms of their investment, including the equity they request and the extent of their involvement in your business. Ensuring these align with your long-term vision can set the stage for a strong, productive partnership and a promising future for your startup.

What can I do to get noticed by the top pre-seed investors featured in this article?

To grab the attention of leading pre-seed investors in 2025, it’s essential to emphasize the progress your startup has made. Focus on showcasing a solid minimum viable product (MVP), key milestones you've achieved, and growth metrics that highlight your potential. Investors are naturally drawn to startups that can demonstrate measurable success and a clear, compelling vision for the future.

Equally important is crafting a well-thought-out outreach strategy. Research potential investors thoroughly - understand their interests, past investments, and the industries they’re passionate about. Build connections through warm introductions, attend networking events, or leverage platforms like LinkedIn to open doors. Engaging with founders in your industry can also offer valuable insights and help you expand your network. By combining consistent effort, thorough preparation, and smart networking, you can set yourself apart in a highly competitive funding landscape.

What are the advantages of joining accelerator programs like Y Combinator or 500 Global?

Joining an accelerator program like Y Combinator or 500 Global can be a game-changer for startups. These programs offer a combination of mentorship, funding, and connections to help early-stage companies grow faster and smarter. They’re designed to sharpen business strategies, find product-market fit, and get startups ready for future funding rounds.

Take Y Combinator, for instance. It provides seed funding, expert advice, and carries a reputation that can boost a startup’s credibility - making it easier to attract investors. On the other hand, 500 Global combines capital with mentorship and practical resources to help startups scale efficiently. Entrepreneurs who join these programs gain access to a network of seasoned industry experts, potential investors, and like-minded founders, all of which can give their business a significant push forward.